Lapsed life insurance policies are commonplace. According to data from AM Best, 7% of all active life insurance policies lapsed in 2024 — up from 5.1% in 2023.

In some cases, financial challenges such as higher premiums combined with fixed incomes make life insurance policies too expensive for seniors, so they let their policies lapse to save money. In others, emotional considerations play a role. For example, a couple that experiences a late-in-life divorce may let a joint life insurance policy lapse rather than dealing with the emotional fallout.

The most common reason for lapsed policies, however, is more straightforward: Many policyholders don’t realize that selling their policy is an option.

WHAT HAPPENS WHEN A LIFE INSURANCE POLICY LAPSES?

Letting a life insurance policy lapse means you stop paying premiums. As a result, all policy benefits are terminated. For example, if you stop paying the premium for your $500,000 policy, the consequences of letting your life insurance lapse are that your beneficiaries will no longer receive any benefits when you die, and you won’t recoup any of the premiums you’ve paid.

Policies lapse for many reasons. First are unaffordable premiums. Seniors on fixed incomes may struggle to pay whole life premiums as cost-of-living expenses and healthcare spending rise. In other cases, policyholders no longer need coverage because they have investments or other income sources that provide financial security. Policies may also outlive their original purpose, such as coverage that was meant to provide for young children if parents died unexpectedly. Once these children are adults with their own families, jobs and insurance policies, the original coverage is no longer necessary.

It’s important to recognize the difference between a policy surrender and letting your policy lapse. If you surrender your policy to your provider, you are given a lump sum in accordance with your insurance agreement. If you let your policy lapse, you typically receive nothing.

THE FINANCIAL IMPACT OF LETTING A POLICY LAPSE

Letting a policy lapse comes with important financial consequences, including:

- Years of premiums paid with no return

- Loss of cash or market value

- Missed asset-to-liquidity opportunity

Many policies lapse quietly and without review. Once lapsed, these polices cannot be restarted, meaning any potential financial benefits are lost.

WHAT DOES SELLING A LIFE INSURANCE POLICY MEAN?

Selling a life insurance policy, also called a life settlement, is the process of selling your policy to a third-party buyer. You can choose to shop the market and sell your policy yourself or leverage a life settlement broker to help you find possible buyers. Reputable brokers offer the advantage of experience and connection, which allows them to find multiple buyers to compete for your policy.

Who Qualifies for a Life Insurance Settlement?

Several factors influence eligibility for a life insurance settlement. They include:

- Age: In most cases, policyholders must be 65 or older. There may be exceptions if you are younger than 65 but have specific medical conditions.

- Insurance type: Term life, convertible term life, whole life and universal life policies can all qualify for life insurance settlements.

- Policy size: Death benefits must be $100,000 or more to be eligible for a life settlement.

- Overall health: Your overall health can impact the value of the settlement you receive. Put simply, poor health typically means higher settlements since death benefits will likely pay out sooner.

Once your policy is sold, the buyer takes over all premiums — and they’ll receive the death benefit when you pass away.

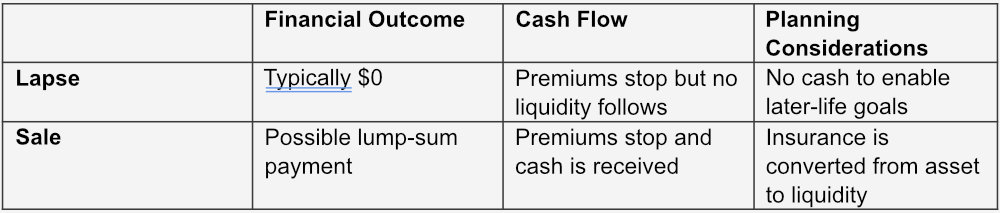

SELLING A LIFE INSURANCE POLICY VS. LETTING IT LAPSE: A SIDE-BY-SIDE COMPARISON

Here’s a look at life settlement vs. lapse options side-by-side.

Put simply, policy sales can help support retirement needs. While a life settlement requires more work than letting a policy lapse, it is typically worth the extra effort.

WHY SO MANY POLICYHOLDERS LET POLICIES LAPSE WITHOUT EXPLORING A SALE

With life settlements and even policy surrenders offering monetary benefits, why do policyholders let their coverage lapse? Four reasons are common:

- Lack of awareness of policy cash value: Policyholders are often unfamiliar with life settlement options and what they stand to gain from a sale.

- Misunderstanding life insurance: Life insurance is often seen as a “use it or lose it” asset, leading policyholders to assume there are no other options before letting a policy lapse.

- No proactive review: Your insurance needs are not consistent over time. If you don’t review your assets regularly, you may let your policy lapse without careful consideration.

- Discomfort with discussing life insurance: Talking about life insurance means talking about death — a topic that makes some policyholders uncomfortable.

WHEN LETTING A POLICY LAPSE MIGHT MAKE SENSE

While life settlements are typically more advantageous for policyholders, letting a policy lapse may work in some scenarios.

Some policies simply hold no settlement market value. Like any financial commodity, the value of insurance policies fluctuates as economic conditions change. Depending on the type of policy and coverage amount, you could pay more to brokers and agents than you get back in a settlement.

You may also choose to let your policy lapse if it has a very low face value. As noted above, only policies worth $100,000 or more are eligible for life settlements. If you have a policy worth $25,000 or $30,000, even a surrender may not be worth your time.

QUESTIONS TO ASK BEFORE LETTING A POLICY LAPSE

Before you let your policy lapse, ask these four questions:

- Is my policy eligible for a life settlement? If you are over 65 and have a term, whole or universal life insurance policy worth at least $100,000, you likely qualify for a life settlement.

- How much could it be worth? The typical return for a life insurance settlement is between 10% and 25% of the policy’s face value.

- Are there tax considerations? There may be taxes on your life settlement. For example, if you paid $75,000 in premiums but receive a $100,000 settlement, $25,000 of your settlement is taxable.

- Are there alternatives to letting your coverage lapse? Life insurance settlements are one option. You may also choose to surrender your policy and recoup some of its value or renegotiate it to reduce your premiums and adjust your total coverage amount.

LAPSE OR SELL? AVOID A SILENT FINANCIAL LOSS

Lapsing happens quickly and quietly. If you don’t review your policy or simply choose to stop paying your premiums, you lose potential value without any fanfare. As a result, it’s worth reviewing all of your options before walking away from your policy.

Consider whether you’re eligible to sell your life insurance policy for cash. If you’re considering a policy lapse or surrender, Life Settlement Advisors can help. Instead of surrendering a life insurance policy that no longer serves a purpose, you can sell it for a lump sum. Contact us today to explore your options.